If you are probating the will of a loved one, maybe the last thing you want to do is a lot of running around with various papers. The above video describes how we have revamped our practice from the methods of the last three decades to methods which mesh with our times, and will probably mesh with your current situation as well.

West Tennessee Probate Attorney

She will always be Mom

The loss of a loved one

An experienced attorney and a CPA to sort out all the complexities of an estate

A Tennessee attorney with three decades of experience helping clients.

Click the award medallion above for

estate planning information.

Named the best probate lawyer in Memphis. Selected as one of the 10 best family law attorneys in Tennessee by a client satisfaction survey polling actual clients. Selected as a best family lawyer in Memphis. One of the three best rated estate planning atorneys in Memphis. Voted a Top 10 divorce attorney in Memphis by Trust Analytics client ratings.

Click here to ask a probate question of Bob - an AI assistant. He has read TN statue law and the TN probate court manual. He should answer you within 15 to 20 seconds.

As of July, 2023 we were 4.9 of 5 stars for 46 reviews of our Memphis office on Google. - one non-client didn't like the idea of actually paying for service. Many shrug and say - can't win 'em all. But we try to every time.

Our Germantown office has a perfect 5.0 / 5.0 record on the Google reviews for their office, which they gleefully lord over our Memphis staff. The Memphians reply - hey! you've only got 13 to our 46!

Other ratings and awards - 10 Best in Tennessee - family law. Expertise Lawyer - Memphis. Top 3 Estate Planning Lawyer in Memphis. Also, admitted to practice - U.S. Supreme Court. That means excellence.

Click the link: Item 2 = send email. Item 4 = send documents. Item 5 = text or call for divorce, probate, or tax matters.

Click here to explore our entire site, to link into our secure client portal and much more

Send messages. Exchange and store your documents electronically. It is your own private case file with dual factor credential verification and encrypted data tunnels. Think of it as your personal guarded bank vault that only you can access - anytime, from anywhere you are.

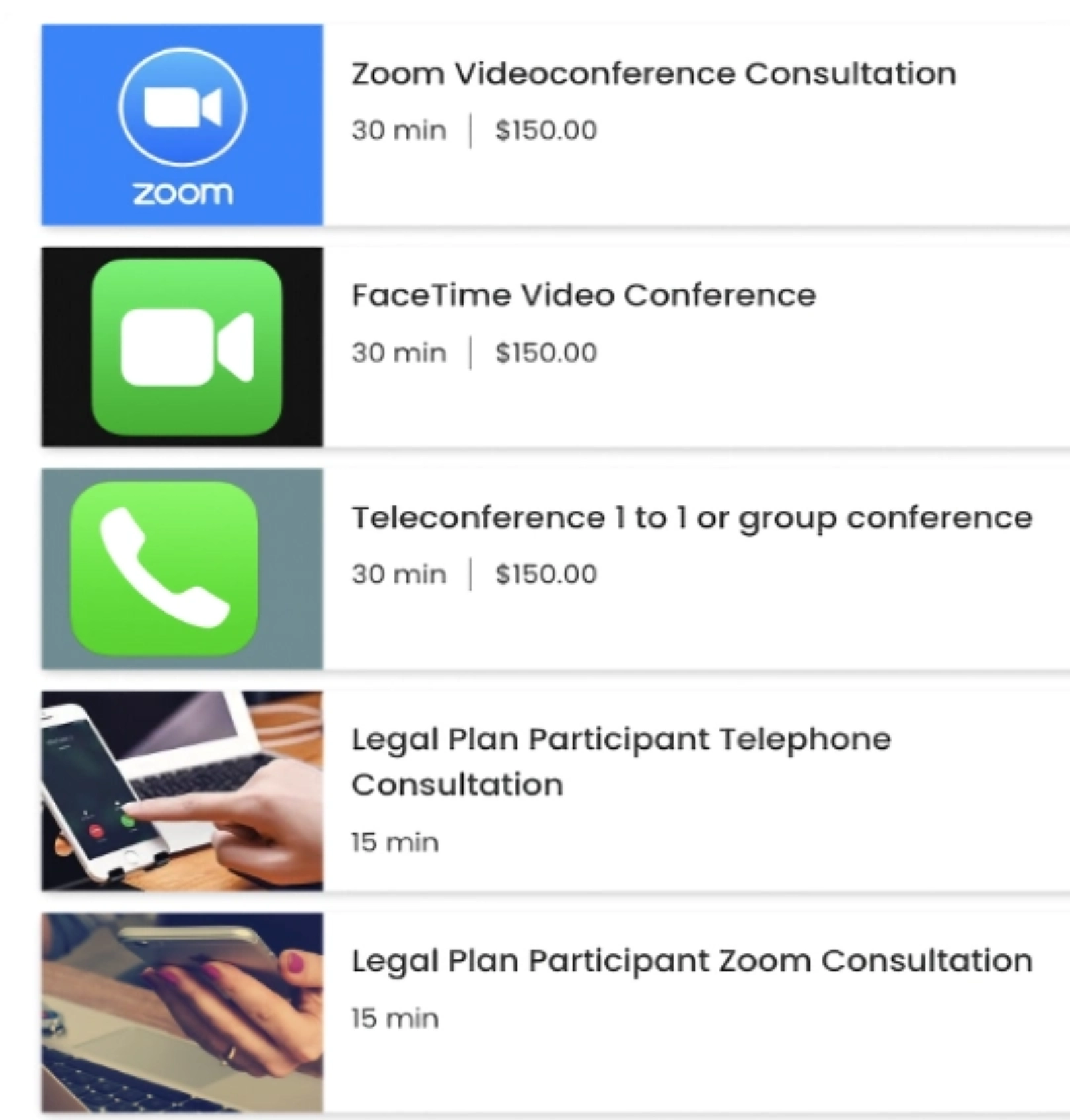

Click the link below to go to our appointment menu on our secure portal. You can schedule a Zoom or a FaceTime or a teleconference from your choice of the available times and dates..